The Hong Kong government has introduced a new “patent box” tax incentive through the Inland Revenue (Amendment) (Tax Concessions for Intellectual Property Income) Ordinance 2024. This new ordinance officially came into effect on 5 July 2024, allowing taxpayers to apply for the incentive retroactively from the 2023/24 year of assessment.

Under this new regime, qualifying profits derived from eligible intellectual property (IP) will be subject to a concessionary tax rate of 5%, significantly lower than Hong Kong’s standard profits tax rate of 16.5%. Eligible IP includes patents, copyrighted software, and new plant variety rights. Notably, eligible IP registered worldwide can qualify for the incentive, provided the profits are sourced in Hong Kong.

To benefit from the tax concession, the eligible IP must be primarily developed by the taxpayer. If the research and development (R&D) process involves acquiring IP or outsourcing R&D activities, the proportion of profits eligible for the concessionary rate may be reduced. Additionally, enterprises will need to obtain local registration for their non-Hong Kong patent and plant variety right to enjoy the concession, a requirement that will come into force two years after the implementation of the “patent box” tax incentive.

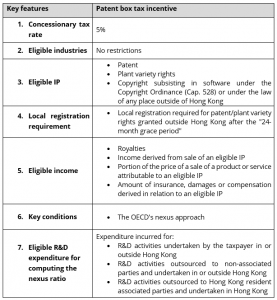

The key amendments are summarized as follows:

The Commerce & Economic Development Bureau stated that this regime encourages enterprises to increase their R&D activities and promotes IP trading, thereby strengthening Hong Kong’s competitiveness as a regional IP trading center. The government views this initiative as a crucial step in enhancing the city’s overall innovation and technology landscape.

For access to the full text of the Ordinance, please refer to the following: https://www.gld.gov.hk/egazette/english/gazette/file.php?year=2024&vol=28&no=27&extra=0&type=1&number=17