The Courts (Remote Hearing) Ordinance (Cap. 654) (the “Ordinance“) came into operation on 28 March 2025, introducing a clear legal framework for the conduct of remote hearings in Hong Kong’s judicial system.

Background and Purpose

As part of the Judiciary’s ongoing technological modernization efforts, remote hearings serve multiple practical purposes. They significantly reduce travel time for parties, legal representatives, and witnesses who would otherwise need to commute to court buildings. This efficiency not only benefits court users but also facilitates more streamlined scheduling of court proceedings. Furthermore, the remote hearing capability enables courts to continue functioning effectively during unforeseen circumstances where physical attendance becomes impractical or impossible.

According to the Hong Kong Judiciary Annual Report 2024, the Judiciary has already successfully conducted approximately 2,100 remote hearings for civil proceedings at different levels of courts and tribunals since 2020. The Ordinance establishes a clear legal basis for remote hearings at various levels of courts and tribunals.

Key Provisions

The Ordinance contains several important provisions that legal practitioners should familiarize themselves with:

New Criminal Offences

One of the most significant aspects of the Ordinance is the introduction of new criminal offences that legal practitioners should be particularly mindful of:

Implementation Timeline

Although the Ordinance is now in effect, implementation will follow a phased approach. The Judiciary has announced plans to begin remote hearings for non-trial criminal proceedings in approximately six months, providing stakeholders adequate time to prepare for the new procedures. In the meantime, the Judiciary will issue practice directions in phases that will specify operational details, application procedures, and technical guidelines for conducting remote hearings effectively.

Practical Implications

The introduction of remote hearings offers substantial efficiency benefits for legal practitioners. Most notably, solicitors and barristers may no longer need to physically attend court for brief procedural hearings (such as “three-minute hearings”), allowing them to participate from their offices instead. This change promises to significantly reduce unproductive travel and waiting time, enabling more efficient allocation of professional resources.

To support this transition, the Judiciary has developed technical support systems and will assign dedicated staff to facilitate remote hearings. This includes conducting pre-hearing connection tests to ensure smooth technical operation during actual proceedings.

Legal practitioners should remain attentive to forthcoming practice directions from the Judiciary, which will provide essential details on implementation procedures, technical requirements, and best practices for participating in remote hearings.

Access the full Ordinance here for more details.

This Friday, our Community Investment Committee attended the 2025 Chinese New Year Card Design Competition Awards at Fresh Fish Traders’ School. We are honoured to feature the winning design as our official Chinese New Year greeting card to clients.

Heartfelt congratulations to the winners and it is our honour to support the efforts of FFTS and to continue a cherished 15-year tradition with sponsoring this inspiring competition. Witnessing the recent developments and learning about the school’s vision and mission was truly inspiring and a reminder of the value of our ongoing involvement with the community.

In Tenwow International Holdings Limited (In Liquidation) and Anor v PricewaterhouseCoopers (a Firm) and PricewaterhouseCoopers Zhong Tian LLP [2024] HKCA 1193, the Court of Appeal (“CA“) ordered a letter of request to be issued by the High Court of Hong Kong to the Shanghai High People’s Court. This request seeks the transfer of audit working papers from the Mainland to Hong Kong pursuant to the Arrangement on Mutual Taking of Evidence in Civil and Commercial Matters between the Courts of the Mainland and the Hong Kong Special Administrative Region (《關於內地與香港特別行政區法院就民商事案件相互委託提取證據的安排》) (“Mutual Arrangement“).

The case involves an audit negligence claim filed by the liquidators of the Tenwow group and one of its subsidiaries against PwC and PwC Zhong Tian (an accounting firm incorporated in the Mainland). The liquidators alleged that PwC Zhong Tian had breached its duties by failing to detect defalcations by way of prepayments made to three supplies and illegitimate financial assistance given to a non-group company related to a director and his associates.

In respect of the audit working papers, the liquidators requested PwC Zhong Tian to provide, inter alia, its working papers; however, PwC Zhong Tian contested that Mainland laws and regulations imposed a blanket prohibition on the unauthorised transfer of audit working papers outside of the Mainland.

Mutual Arrangement

Pursuant to Article 6 of the Mutual Arrangement, the scope of assistance that may be requested by a Hong Kong court in seeking the taking of evidence by a Mainland court under the Mutual Arrangement includes:

(a) obtaining of statements from parties concerned and testimonies from witnesses;

(b) provision of documentary evidence, real evidence, audio-visual information and electronic data; and

(c) conduct of site examination and authentication.

The Court’s Ruling

Pursuant to the Mutual Arrangement, PwC Zhong Tian applied to the Court of First Instance for a letter of request to be issued by the High Court of Hong Kong to the Shanghai High People’s Court. However, such application was rejected by Anthony Chan J on the basis that letters of request were normally issued for obtaining evidence from non-parties, or at most for taking the evidence of a party overseas, rather than for the production of documents and discovery. Further, Anthony Chan J held that obtaining approval from the Mainland authorities did not fall within the categories referred to in Article 6, rendering the Mutual Arrangement inapplicable.

In the appeal, the CA allowed the appeal and ordered a letter of request to be issued for the following reasons, among others:

(a) In a broad sense a letter of request is a formal written document through which a court seeks assistance from a court in another jurisdiction, either under a convention or out of comity and reciprocity. While typically used to obtain evidence from third parties, it does not preclude their issuance to aid a party in fulfilling its own discovery obligations. Therefore, it is not inappropriate in principle to use a court-to-court request procedure in aid of the production of a party’s own documents in light of a legal impediment in the foreign jurisdiction;

(b) A letter of request is only a request. Issuing a letter of request does not necessarily subordinate the court’s power to the penal laws of another jurisdiction. It is a matter of discretion based on the case’s specifics, with no requirement to disregard or prioritise foreign law. The court retains full control over its processes even after a request is issued;

(c) After reviewing the relevant Mainland law and regulations, the CA was cautious about making any firm findings of Mainland law due to absence of oral examination of the experts and a lack of expert evidence regarding the latest Mainland regulation. Nevertheless, the CA concluded that PwC Zhong Tian had demonstrated a real risk that it would be penalised in the Mainland if it simply handed over copies of the audit working papers to the liquidators in Hong Kong without prior approval from the Mainland authorities;

(d) The use of court-to-court procedure is justified, as any requisite approval for the transmission of audit working papers for judicial proceedings should be sought pursuant to the applicable mutual judicial assistance protocol;

(e) The Mutual Arrangement is intended to facilitate the efficient and certain acquisition of evidence for civil and commercial matters by litigants in both jurisdictions. Therefore, there is no reason to interpret the Mutual Arrangement so restrictively as to exclude the present application for approval from the Mainland authorities. The assistance sought through the letter of request falls within the scope of the Mutual Arrangement, and aligns with the policy of Mainland law; and

(f) Concerning the objection based on the submission of futility, the CA determined that, in the absence of any evidence detailing what transpired with the letters of request in previous cases or the reasons for their non-execution, the Court would not infer that a letter of request in the present case would be futile.

Takeaways

Audit working papers are essential documents for the fair disposal of a claim alleging auditors’ negligence. This case marks the first successful application for a letter of request to transfer the audit working papers in a contentious context, serving as a precedent for future cases involving the transfer of such documents from the Mainland to Hong Kong, particularly in audit negligence claims. The CA’s rulings indicate a more flexible interpretation of the Mutual Arrangement, which may foster enhanced cooperation in taking of evidence in civil and commercial matters between Hong Kong and the Mainland in future cases.

The full judgment can be accessed here.

In response to Hong Kong’s evolving healthcare needs amid an aging population, Hong Kong has enacted the Advance Decision on Life-sustaining Treatment Ordinance (the “Ordinance”). Passed by the Legislative Council on 20 November 2024 and gazetted on 29 November 2024, this legislation establishes a comprehensive framework for advanced healthcare decisions. The implementation includes an 18-month transition period, allowing medical institutions, relevant departments, and organizations to update their protocols and systems, and conduct necessary staff training. To support implementation, the Hong Kong Academy of Medicine will introduce practice guidelines in the first quarter of 2025.

At its core, the concept of Advance Medical Directives is fundamentally rooted in patients’ rights to self-determination and human dignity. While patients have the right to make informed healthcare decisions, including refusing treatment, several critical questions arise: primarily, how can they exercise this right when their decision-making capacity becomes impaired, and what effect should their previously expressed wishes have on subsequent medical decisions?

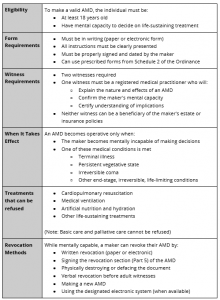

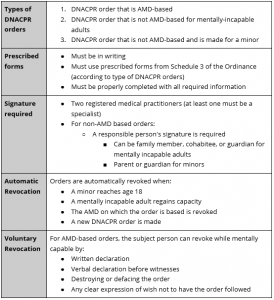

To address these challenges, the Ordinance introduces two key advance decision instruments that empower individuals to make informed choices about their future medical care: (i) Advance Medical Directives and (ii) Do-Not-Attempt Cardiopulmonary Resuscitation orders. The legislation is particularly significant because, prior to its enactment, determining the validity and applicability of Advance Medical Directives in certain circumstances often involved legal uncertainties, placing medical professionals and patients’ family members in challenging situations.

Here are some key takeaways:

Advance Medical Directives (“AMDs”)

What is an AMD?

An AMD enables individuals to specify in advance their wishes regarding life-sustaining treatments for situations where they become mentally incapable of making such decisions. These legally binding documents provide healthcare professionals with clear guidance while respecting patients’ autonomy.

What is a DNACPR Order?

A Do-Not-Attempt Cardiopulmonary Resuscitation order is a legal document that directs healthcare providers not to perform cardiopulmonary resuscitation when a person experiences cardiopulmonary arrest. This means if the person’s heart stops beating or they stop breathing, healthcare providers will not attempt: (i) Chest compressions; (ii) Artificial ventilation; and (iii) Defibrillation

Transitional Arrangement

To ensure a seamless transition to the new legal framework, the Ordinance includes comprehensive transitional provisions for existing advance care planning instruments. Under these provisions, pre-existing AMDs that comply with the Ordinance’s requirements will remain valid. Nevertheless, individuals are encouraged to review their existing directives and consider updating them using the newly prescribed forms. Similarly, for pre-existing DNACPR Orders, the Hospital Authority will facilitate their transition to align with the Ordinance’s forms before the commencement dates, thereby ensuring the continued effectiveness of all advance care planning instruments.

Important considerations

The Ordinance marks a significant advancement in Hong Kong’s healthcare landscape, providing residents with greater autonomy over their end-of-life care while ensuring clear guidance for healthcare providers. When considering these advance decision instruments, individuals are recommend to:

By following these recommended steps, individuals can ensure that their advance decisions accurately reflect their wishes and can be effectively implemented when needed.

Access the full Ordinance here for more details.

In Hui Chun Ping v Hui Kau Mo [2024] HKCFA 32, the Court of Final Appeal (“CFA”) has handed down its judgment which provided important clarification on the applicability of a 6-year limitation period for “constructive trustees”.

The case of Hui Chun Ping concerns an agent (the Defendant) who has made a secret profit in breach of his fiduciary duty owed to the principal (the Plaintiff). The Plaintiff contended, among other things, that the Defendant was a “constructive trustee” who held the unlawful gains on constructive trust on his behalf. The key issue before the CFA was whether such a claim had been time-barred by virtue of section 20 of the Limitation Ordinance (“LO“).

Section 20 of the Limitation Ordinance

Under section 20 of the LO, all actions in respect of trust property are time-barred after a 6-year limitation period unless they fall within the exempted categories of section 20(1), to which no limitation period applies. The exempted categories under section 20(1) are:-

a) An action by a beneficiary “in respect of any fraud or fraudulent breach of trust to which the trustee was a party or privy“; or

b) An action by a beneficiary “to recover from the trustee trust property or the proceeds thereof in the possession of the trustee, or previously received by the trustee and converted to his use“.

The LO adopts the definition of a “trustee” under the Trustee Ordinance (Cap. 29), which includes a constructive trustee.

Ruling of the Court of Final Appeal

The Plaintiff’s contention that the Defendant was a “constructive trustee” within the ambit of section 20(1)(b) was rejected by the Court of First Instance, the Court of Appeal and finally confirmed by the CFA.

Having considered earlier authorities which pointed out the terminological confusion caused by judges who have used the term “constructive trustees” loosely, the CFA reiterates the distinction between:

a) “constructive trustees” who have previously accepted fiduciary duties in relation to the principal’s property prior to a subsequent breach of trust (e.g. where a defendant agreed to buy property for the plaintiff but the trust was imperfectly recorded) (“Category 1 trustees“); and

b) “constructive trustees” whose trusteeship arose solely as a result of their wrongful conduct (e.g. making a secret and unauthorised profit) (“Category 2 trustees“).

In line with the statutory intention and legal precedents, only Category 1 trustees are “constructive trustees” within the meaning of section 20(1) of the LO. They are “trustees” in the traditional sense in that they do not receive trust property in their own right but by a transaction which both parties intended to create a trust from the outset.

Properly characterised on the facts of this case, the CFA determined that the Defendant was a Category 2 trustee, thus falling outside of the scope of section 20(1) of the LO, resulting in the Plaintiff’s primary claim being time-barred. The consequential effect of this finding meant the Plaintiff’s alternative claims for (i) equitable compensation, and (ii) accounts and inquiries (which were either substantially in the same form of, or ancillary to the main claim) were equally rejected by the CFA as being time-barred.

Conclusion

In light of Hui Chun Ping v Hui Kau Mo [2024] HKCFA 32, beneficiaries and victims of wrongful conduct who are considering a claim in relation to a constructive trust are reminded to take heed of the distinction between Category 1 trustees and Category 2 trustees, and if applicable promptly take out an action before the statutory limitation period expires.

The full judgment of Hui Chun Ping v Hui Kau Mo can be viewed here.

See news from our global offices