The Hong Kong regulators are taking actions in relation to their concerns regarding dubious loan transactions in listed companies. In mid-2023, the Securities and Futures Commission (SFC) and the Accounting and Financial Reporting Council (AFRC) published a joint statement on common regulatory concerns and provided guidance on conduct standards in relation to loans or other financial arrangements. In relation to misconduct of listed companies and directors, the April 2024 edition of the Enforcement Bulletin of the Hong Kong Stock Exchange (“HKEX“) discusses red flags commonly seen in lending arrangements of listed issuers and provides practical tips on compliance.

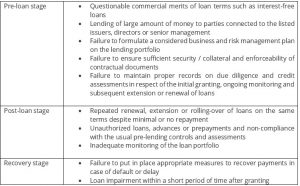

In recent years, the number of regulatory investigations involving loans, advances and other similar arrangements made by listed issuers has been on the rise. Some of the red flags below are often seen in various phases of the lending arrangements:-

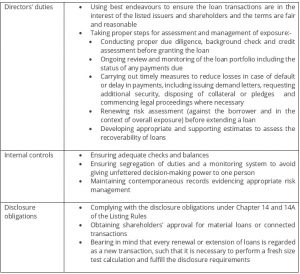

The Bulletin also provides practical tips on how to ensure compliance in respect of three areas which are the HKEX’s focus and major concerns, namely (i) directors’ duties, (ii) internal controls and (iii) disclosure obligations:-

The Bulletin serves as an important reminder of the HKEX’s rigorous oversight on loans, advances and other similar arrangements of listed companies. Listed companies and directors are advised to ensure that appropriate internal control measures are in place and the disclosure obligations under Chapters 14 and 14A of the Listing Rules are complied with. Directors should bear in mind their obligations under the Listing Rules, including a duty to safeguard the company’s assets, and they could be asked to demonstrate proper actions have been taken in accordance with established policies and procedures by producing relevant written records. Any material failure in safeguarding the assets of the listed company and/or giving due consideration regarding commercial rationale of proposed loan transactions will likely trigger regulatory investigations and enforcement actions.